59% of customers expect businesses to personalize their experiences based on the available data. This requires companies to deliver faster, more personalized, and smarter customer experiences across various channels.

To meet customer expectations, using customer service AI tools can have a positive impact on revenue generation. Here are some general statistics that highlight the benefits of AI customer service for organizations:

- According to a study by Salesforce, 51% of service decision-makers reported that AI has increased their revenue.

- A report by Gartner predicts that by 2025, AI technologies will be used in 95% of customer interactions, and companies that invest in AI customer experience solutions will see revenue increase by up to 25%.

Understand how to use custom vision AI and Power BI to build a bird recognition app

- In a survey conducted by PwC, 72% of business leaders believe that AI is a business advantage that will help them outperform competitors and increase revenue.

- According to a study by Accenture, 73% of customers are willing to pay more for a product or service if they receive a personalized experience. AI tools can enable businesses to provide personalized customer experiences, leading to increased customer satisfaction and revenue.

- A report by Harvard Business Review found that companies that leverage AI in customer service can achieve cost savings of up to 30% and experience revenue growth of up to 10%.

While these statistics demonstrate the potential impact of AI on revenue generation, it is important to note that the specific results may vary depending on the industry, implementation strategy, and the unique circumstances of each business.

Quick Read: AI-Powered CRM Smart Customer Management

Why Use AI in Customer Service?

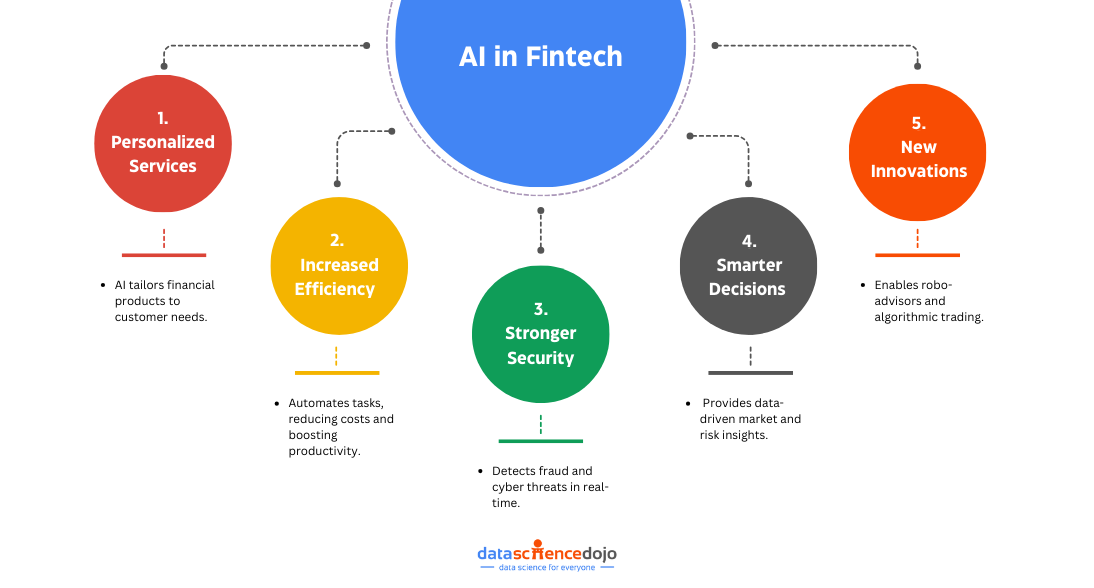

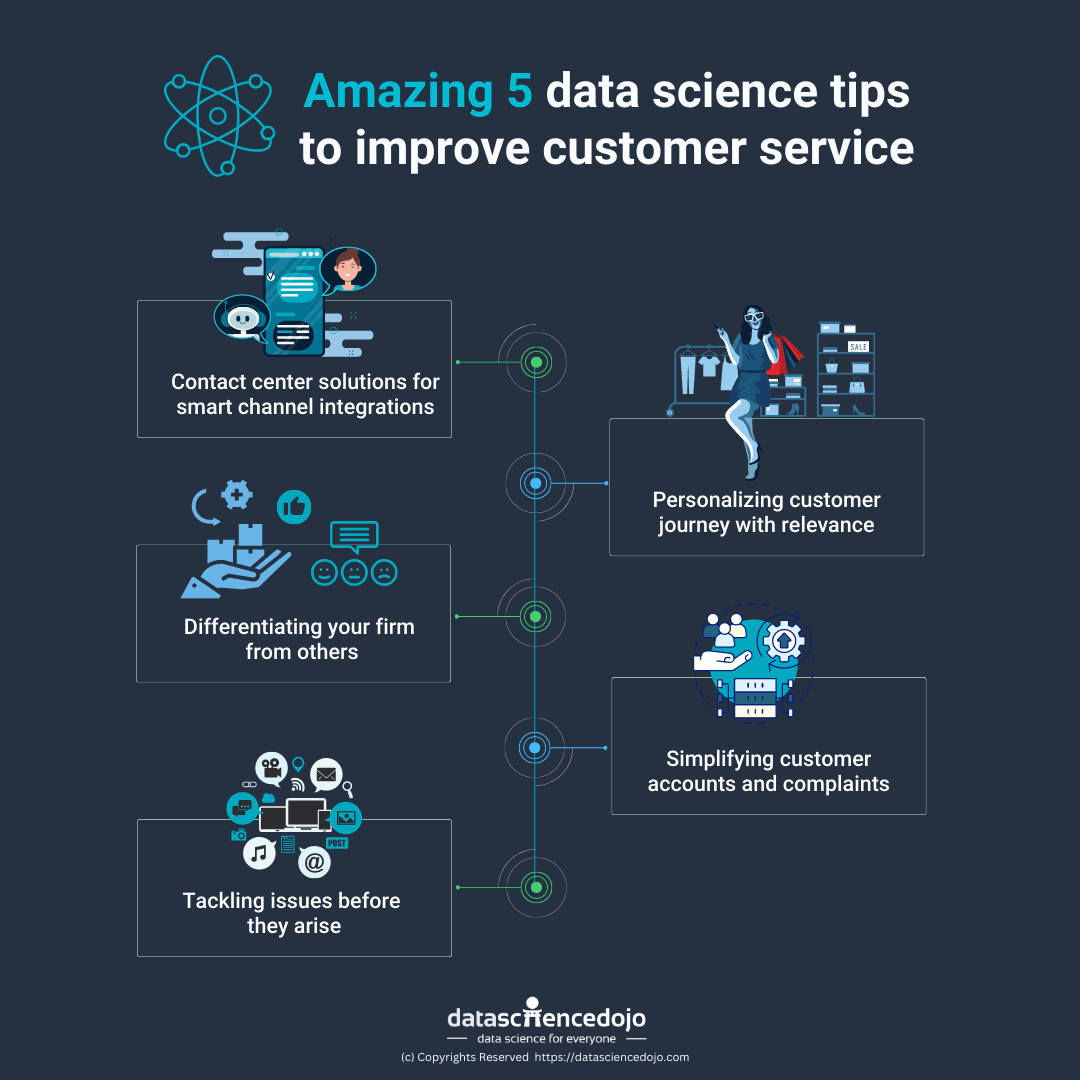

AI can streamline the customer service experience in several ways:

Explore Trending 5 Customer Service AI Tools to Boost 25% of Revenue

- Handling large volumes of data: AI can swiftly analyze vast amounts of customer data, extracting valuable insights and patterns that can improve customer service.

- Reducing average handling times: AI-powered chatbots and voice biometrics can provide immediate responses, reducing the time it takes to resolve customer inquiries.

- Personalizing experiences: AI can create unique customer profiles by analyzing customer interactions, allowing businesses to deliver hyper-personalized offerings and make customers feel valued.

- Optimizing operations: AI can analyze customer calls, emails, and chatbot conversations to identify signs of customer escalation, help improve the customer experience, and find new ways to enhance operations.

Learn AI-powered marketing

- Enhancing efficiency: AI can automate routine tasks, freeing up customer service agents to focus on more complex and value-added activities that require creative problem-solving and critical thinking.

- Providing proactive service: AI can draw information from customer contracts, purchase history, and marketing data to surface personalized recommendations and actions for agents to take with customers, even after the service engagement is over.

- Improving support quality: AI-powered sentiment analysis tools can monitor customer feedback and social media interactions to gauge customer sentiment, identify areas for improvement, and personalize experiences based on customer preferences.

- Intelligent routing: AI-based intelligent routing systems can analyze incoming customer inquiries and route them to the service representative or department with the most relevant experience or knowledge, ensuring efficient and effective problem resolution.

Overall, AI streamlines the customer service experience by improving efficiency, personalization, and responsiveness, leading to higher customer satisfaction and loyalty.

Challenges of Using AI Customer Service

Managing customer service for companies can be a challenging task, with several obstacles that need to be overcome. Another challenge is the impact on the workforce, as 66% of service leaders believe that their teams lack the skills needed to handle AI, which is increasingly being used in customer service.

Trust and reliability issues also pose a challenge, as AI technology is still evolving and there may be concerns about the accuracy and privacy of AI systems.

Learn more about AI as a Service (AIaaS)

Additionally, the investment and implementation of AI in customer service can be costly and require technical expertise, making it difficult for small businesses or organizations with limited resources to adopt AI solutions.

Despite these challenges, the future of AI in customer service looks promising, with AI evolving to improve efficiency and customer loyalty. Overall, managing customer service requires companies to navigate these challenges and adapt to the changing landscape of customer expectations and technological advancements.

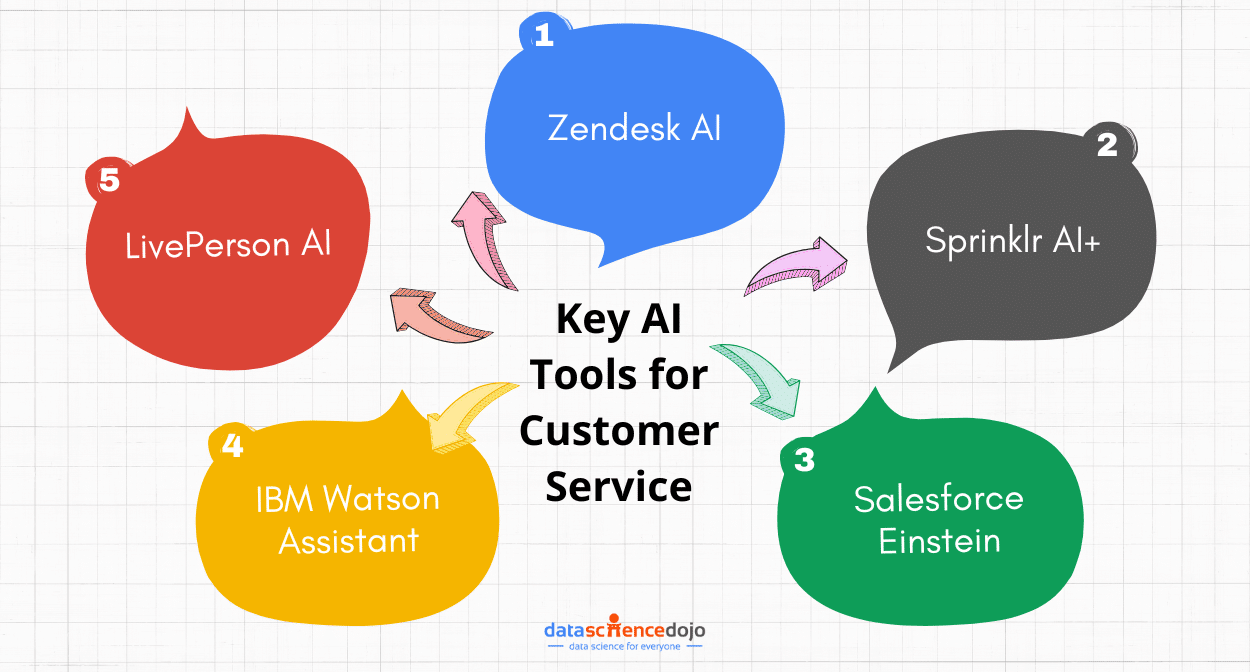

Top 5 Customer Service AI Tools – Key Features, Pricing and Use-Cases

There are several AI-powered customer service tools available today that can greatly enhance the customer experience. Here are some of the top tools and their key features:

Explore 15 Spectacular AI, ML, and Data Science Movies

1. Zendesk AI

Zendesk offers a range of AI-powered tools for customer service, including chatbots, natural language processing (NLP), sentiment analysis, and intelligent routing.

These tools can automate responses, understand customer sentiment, route inquiries to the right agents, and provide personalized recommendations based on customer data. Zendesk’s AI tools also include advanced bots, intelligent triage, intelligence in the context panel, and content cues.

Key Features of Zendesk AI Tools

- Ticketing System:

– Zendesk provides a robust ticketing system that allows businesses to manage customer inquiries, issues, and support requests efficiently.

– Pricing: Zendesk offers a variety of pricing plans, including the Essential plan starting at $5 per agent per month, the Team plan starting at $19 per agent per month, and the Professional plan starting at $49 per agent per month.

- Multi-Channel Support:

– Zendesk enables businesses to provide support across multiple channels, including email, chat, social media, and phone, all from a centralized platform.

– Pricing: The Team plan includes multi-channel support and starts at $19 per agent per month.

- Self-Service Options:

– Zendesk includes a knowledge base and community forums feature, allowing customers to find answers to common questions and engage with other users for peer-to-peer support.

– Pricing: The Professional plan includes self-service options and starts at $49 per agent per month.

- Automation and Workflow Management:

– Zendesk offers automation tools to streamline support processes and customizable workflows to ensure efficient handling of customer inquiries.

– Pricing: The Professional plan includes advanced automation and workflow management features, starting at $49 per agent per month.

- Reporting and Analytics:

– Zendesk provides comprehensive reporting and analytics tools to track key support metrics, customer satisfaction, and agent performance.

– Pricing: The Professional plan includes reporting and analytics features, starting at $49 per agent per month.

Know about 12 excellent data analytics books you should read

- Integration Capabilities:

– Zendesk integrates with a wide range of third-party apps and tools, allowing businesses to connect their customer support operations with other business-critical systems.

– Pricing: The Professional plan includes integration capabilities and starts at $49 per agent per month.

Overall, Zendesk offers a range of features to support businesses in delivering exceptional customer service. The pricing plans vary based on the features and capabilities included, allowing businesses to choose the right plan based on their specific needs and budget.

2. Sprinklr AI+:

Sprinklr AI+ is a unified platform for social media management that incorporates AI to enhance customer service. With features like content generation, chatbots, natural language processing (NLP), sentiment analysis, and recommendation systems, Sprinklr AI+ enables personalized responses, quick query handling, and sentiment monitoring across social media channels.

3. Salesforce Einstein:

Salesforce Einstein is an AI-powered platform that provides various customer service tools. One key feature is Einstein Copilot, an AI assistant that helps agents generate personalized responses to service inquiries.

It can analyze relevant customer data, knowledge articles, or trusted third-party sources to provide natural language responses on any channel. Salesforce Einstein also offers intelligent routing, self-service solutions, and predictive analytics to optimize customer service operations.

Key Features of the Salesforce Einstein Tool

Here are some key features and benefits of the Salesforce Einstein Chatbot:

- Conversational Experience: Salesforce Einstein Chatbot allows customers to engage in natural, conversational interactions using text or voice. It understands and responds to customer queries, providing a seamless and intuitive user experience.

- Intelligent Routing: The chatbot uses intelligent routing capabilities to ensure that customer inquiries are directed to the most appropriate agent or department. This helps streamline the support process and ensures that customers receive prompt and accurate assistance.

- Personalization: Salesforce Einstein Chatbot utilizes machine learning algorithms to analyze customer data and personalize interactions. It can understand customer preferences, history, and behavior to provide tailored recommendations and suggestions, enhancing the overall customer experience.

Understand AI-driven personalization in marketing

- Automated Workflows: The chatbot can automate routine tasks and workflows, such as gathering customer information, updating records, and processing simple requests. This saves time for both customers and support staff, enabling them to focus on more complex and value-added tasks.

- Integration with CRM: Salesforce Einstein Chatbot seamlessly integrates with the Salesforce CRM platform, allowing customer interactions to be captured and tracked.

Dive more into AI CRM

- Analytics and Reporting: The chatbot provides analytics and reporting capabilities, allowing businesses to measure and analyze the effectiveness of their customer interactions. This helps identify areas for improvement and optimize the chatbot’s performance over time.

It’s important to note that while the information provided above is based on general knowledge about Salesforce Einstein Chatbot, I do not have access to specific details about its features and capabilities.

4. IBM Watson Assistant

IBM Watson Assistant is an AI-powered virtual assistant that can handle customer inquiries and provide personalized responses. It uses natural language processing (NLP) to understand customer queries and can be integrated with various channels, including websites, mobile apps, and messaging platforms.

Learn 7 NLP Techniques and Tasks to Implement Using Python

Watson Assistant can also be trained on specific models to recognize patterns and accurately respond to customer questions, saving time and effort.

Key features of IBM Watson Assistant

One of the key strengths of IBM Watson Assistant is its multi-channel support. It can be seamlessly integrated across various channels, including websites, mobile apps, messaging platforms, and more. This allows businesses to provide a consistent and personalized user experience across different touchpoints.

Watson Assistant can be trained on specific models to recognize patterns and accurately respond to customer questions. This training capability enables the assistant to continuously learn and improve over time, ensuring that it delivers accurate and relevant information to users.

Moreover, IBM Watson Assistant offers integration capabilities, allowing businesses to integrate it with other systems and tools. This integration enables the assistant to leverage existing data and infrastructure, enhancing its functionality and providing more comprehensive support to users.

Another notable feature of the IBM Watson Assistant is its contextual understanding. The assistant is capable of maintaining context within a conversation, which means it can remember previous interactions and provide more accurate and personalized responses.

This contextual understanding helps create a more natural and engaging conversational experience for users.

Furthermore, IBM Watson Assistant provides analytics and insights to businesses. These analytics help organizations understand user interactions, identify patterns, and gain valuable insights into user behavior. By analyzing this data, businesses can continuously improve the assistant’s performance and enhance the overall customer experience.

5. LivePerson AI:

LivePerson AI offers AI-powered chatbots and virtual assistants that can handle customer inquiries and provide instant responses. These chatbots can be trained to understand customer intent, sentiment, and language, allowing for more natural and personalized interactions. LivePerson AI also offers intelligent routing, multilingual support, and agent onboarding and training assistance.

These AI customer service tools provide a range of features to streamline customer interactions, improve response times, and enhance the overall customer experience.

From automated responses and sentiment analysis to personalized recommendations and intelligent routing, these tools leverage AI technology to optimize customer service operations and deliver exceptional support.

Here’s a guide to LLM chatbots

Should Organizations Build Custom AI Chatbots?

Building a custom AI chatbot can be a strategic decision for companies, but it requires careful consideration of various factors. Implementing a custom AI chatbot offers several advantages, such as tailored functionality, unique branding, and full control over the development process.

However, it also comes with challenges, including the need for specialized expertise, significant time and resource investment, and ongoing maintenance and updates.

Here are some key points to consider when deciding whether to build a custom AI chatbot:

-

**Unique Functionality and Branding**:

– Building a custom AI chatbot allows companies to create unique features and capabilities tailored to their specific customer service needs.

– Custom chatbots can be designed to reflect the brand’s tone, voice, and personality, providing a more personalized and consistent customer experience.

-

**Control and Flexibility**:

– Companies have full control over the development, integration, and customization of a custom AI chatbot, enabling them to adapt to changing business requirements and customer preferences.

– Custom chatbots can be tailored to integrate seamlessly with existing systems and workflows, providing a more cohesive and efficient customer service experience.

-

**Expertise and Resources**:

– Developing a custom AI chatbot requires access to specialized AI development expertise, including data scientists, machine learning engineers, and natural language processing (NLP) specialists.

Explore Attention Mechanism in NLP

– Companies need to allocate significant resources, including time, budget, and technical infrastructure, to build and maintain a custom AI chatbot.

-

**Time to Market**:

– Building a custom AI chatbot from scratch can take a considerable amount of time, from initial development to testing and deployment, potentially delaying the benefits of AI-enhanced customer service.

– Custom chatbot development may involve a longer time to market compared to using pre-built AI platforms or tools, impacting the speed of implementation and realization of benefits.

-

**Maintenance and Updates**:

– Custom chatbots require ongoing maintenance, updates, and enhancements to keep up with evolving customer needs, technological advancements, and industry trends.

– Companies must have a plan in place for continuous monitoring, improvement, and optimization of a custom chatbot to ensure its effectiveness and relevance over time.

Build your Custom Chatbot with Data Science Dojo

While building a custom AI chatbot offers the potential for tailored functionality and full control, companies should carefully evaluate the expertise, resources, time, and long-term maintenance requirements before making the decision.