From revolutionizing healthcare to enhancing customer service, AI is transforming industries at an incredible pace. One of its most fascinating applications is in stock market predictions, where AI-driven models analyze vast amounts of data to identify trends, forecast prices, and assist traders in making informed decisions.

The financial world has always relied on data-driven insights, but traditional methods often struggle to keep up with the complexity and volatility of modern markets. With the rise of machine learning and deep learning, AI can now spot patterns that human analysts might miss, providing more accurate and timely predictions.

However, despite its potential, AI-driven stock forecasting isn’t without its challenges. Factors like data quality, market unpredictability, and human emotions still play a crucial role in financial decision-making.

In this blog, we’ll explore the evolution of AI, and how it is revolutionizing stock market forecasting. This guide will provide valuable insights into the growing synergy between AI and the financial world.

The Evolution of Artificial Intelligence in Modern Technology

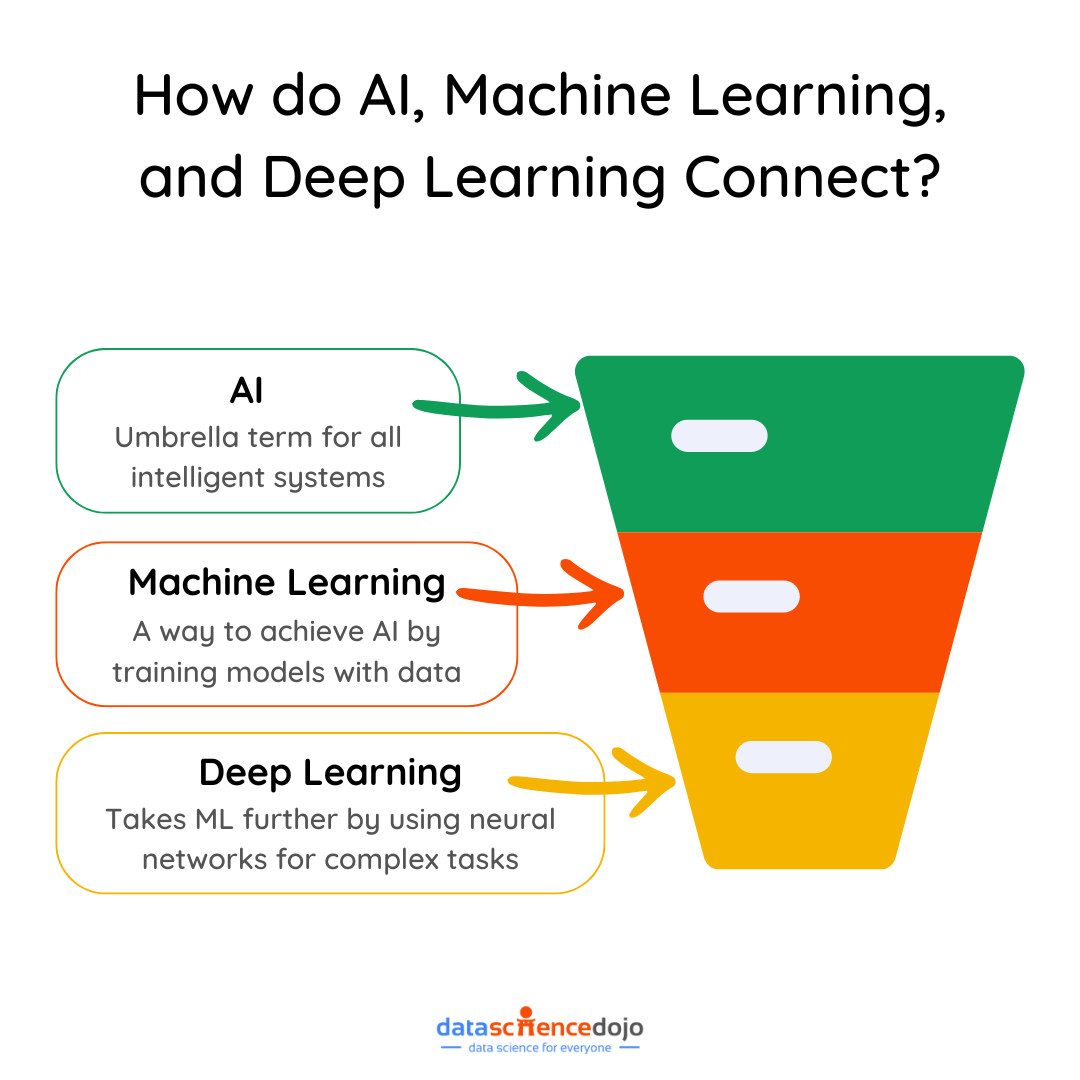

Artificial Intelligence (AI) has come a long way from its early days. What started as simple rule-based programming has now transformed into complex systems capable of learning and making decisions on their own. AI’s growth can be seen in its two major advancements: machine learning (ML) and deep learning (DL).

Machine learning enabled computers to learn from data, identify patterns, and improve over time. This shift made AI more flexible and capable of handling tasks like speech recognition, recommendation systems, and fraud detection. However, it has its limitations since ML requires structured data and struggles with complex problems.

These limitations led to the idea of deep learning that uses artificial neural networks to process large amounts of unstructured data. These networks allow AI to recognize images, understand languages, and even predict trends with remarkable accuracy.

Read more about the idea of AI as a Service

How Deep Learning and Neural Networks are Connected to AI?

Deep learning models use a structure known as a “Neural Network” or “Artificial Neural Network (ANN).” AI, ML, and deep learning are interconnected, much like nested circles. Perhaps the easiest way to imagine the relationship between these three concepts is to compare them to Russian Matryoshka dolls.

That is, in such a way that each one is nested and a part of the previous one. That is, machine learning is a sub-branch of artificial intelligence, and deep learning is a sub-branch of machine learning, and both of these are different levels of artificial intelligence.

The Synergy of AI, Machine Learning, and Deep Learning

Machine learning actually means the computer learns from the data it receives, and algorithms are embedded in it to perform a specific task. Machine learning involves computers learning from data and identifying patterns. Deep learning, a more complex form of machine learning, uses layered algorithms inspired by the human brain.

Deep learning describes algorithms that analyze data in a logical structure, similar to how the human brain reasons and makes inferences. To achieve this goal, deep learning uses algorithms with a layered structure called Artificial Neural Networks. The design of algorithms is inspired by the human brain’s biological neural network.

AI algorithms now aim to mimic human decision-making, combining logic and emotion. For instance, deep learning has improved language translation, making it more natural and understandable.

Read about: Top 15 AI startups developing financial services in the USA

A clear example that can be presented in this field is the translation machine. If the translation process from one language to another is based on machine learning, the translation will be very mechanical, literal, and sometimes incomprehensible.

But if deep learning is used for translation, the system involves many different variables in the translation process to make a translation similar to the human brain, which is natural and understandable. The difference between Google Translate 10 years ago and now shows such a difference.

Explore the data science vs AI vs machine learning comparison

AI’s Role in Stock Market Forecasting: A New Era

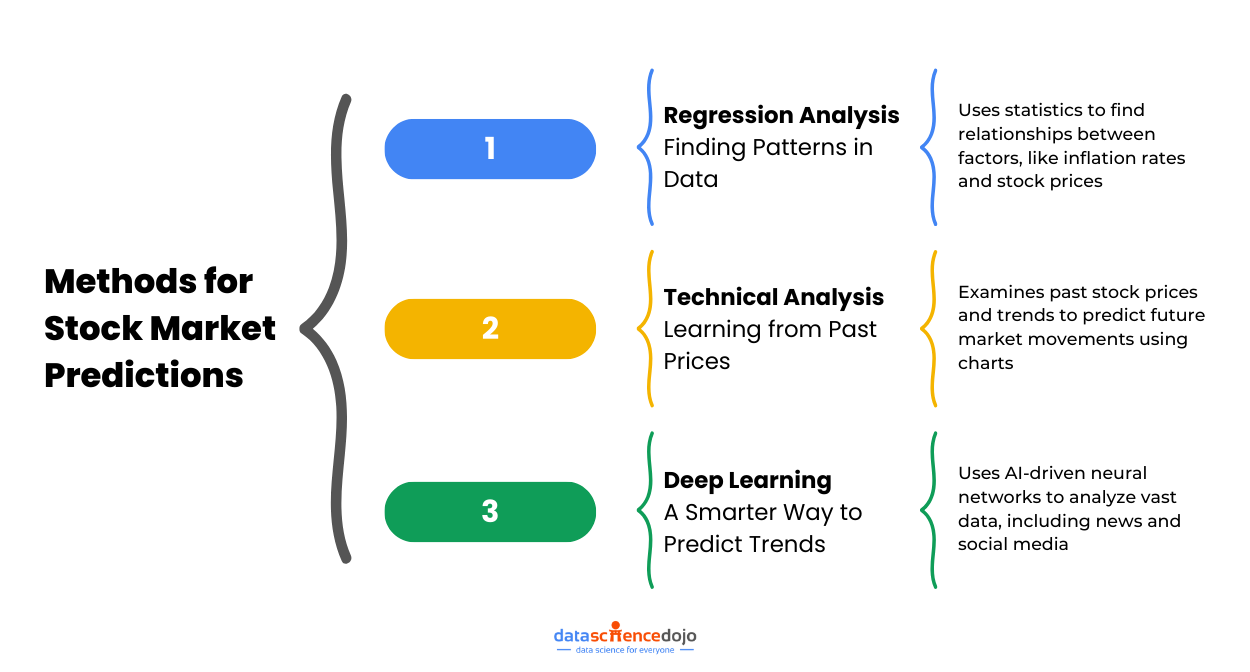

One of the capabilities of machine learning and deep learning is stock market forecasting. Today, in modern ways, predicting price changes in the stock market is usually done in three ways.

- The first method is regression analysis. It is a statistical technique for investigating and modeling the relationship between variables.

For example, consider the relationship between the inflation rate and stock price fluctuations. In this case, the science of statistics is utilized to calculate the potential stock price based on the inflation rate.

- The second method for forecasting the stock market is technical analysis. In this method, by using past prices and price charts and other related information such as volume, the possible behavior of the stock market in the future is investigated.

Here, the science of statistics and mathematics (probability) are used together, and usually linear models are applied in technical analysis. However, different quantitative and qualitative variables are not considered at the same time in this method.

- The third method is deep learning. It uses artificial neural networks (ANNs) to analyze vast amounts of data, including news reports, social media trends, and global events. This helps detect subtle market signals that influence stock prices.

While we have reviewed the three methods, let’s dig deeper into the role of deep learning in financial forecasting and stock market predictions.

The Power of Artificial Neural Networks in Financial Forecasting

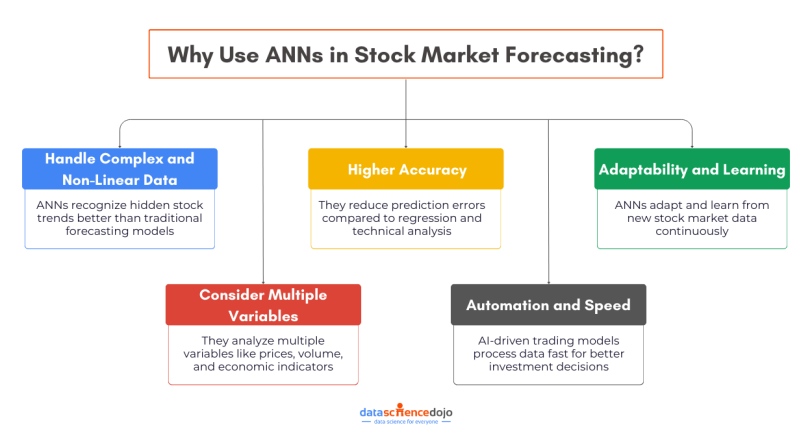

If a machine only performs technical analysis on the developments of the stock market, it has actually followed the pattern of machine learning. But another model of stock price prediction is the use of deep learning artificial intelligence, or ANN.

Artificial neural networks excel at modeling the non-linear dynamics of stock prices. They are more accurate than traditional methods. Also, the percentage of neural network error is much lower than in regression and technical analysis.

Today, many market applications such as Sigmoidal, Trade Ideas, TrendSpider, Tickeron, Equbot, Kavout are designed based on the second type of neural network and are considered to be the best applications based on artificial intelligence for predicting the stock market.

However, it is important to note that relying solely on artificial intelligence to predict the stock market may not be reliable. There are various factors involved in predicting stock prices, and it is a complex process that cannot be easily modeled.

Emotions often play a role in the price fluctuations of stocks, and in some cases, the market behavior may not follow predictable logic. Social phenomena are intricate and constantly evolving, and the effects of different factors on each other are not fixed or linear. A single event can have a significant impact on the entire market.

For example, when former US President Donald Trump withdrew from the Joint Comprehensive Plan of Action (JCPOA) in 2018, it resulted in unexpected growth in Iran’s financial markets and a significant decrease in the value of Iran’s currency.

Iranian national currency has depreciated by %1200 since then. Such incidents can be unprecedented and have far-reaching consequences.

Furthermore, social phenomena are always being constructed and will not have a predetermined form in the future. The behavior of humans in some situations is not linear and just like the past, but humans may show behavior in future situations that is fundamentally different from the past.

The Limitations of AI in Stock Market Predictions

While artificial intelligence only performs the learning process based on past or current data, it requires a lot of accurate and reliable data, which is usually not available to everyone. If the input data is sparse, inaccurate, or outdated, it loses the ability to produce the correct answer.

Maybe the AI will be inconsistent with the new data it acquires and will eventually reach an error. Fixing AI mistakes needs lots of expertise and tech know-how, handled by an expert human. Another point is that artificial intelligence may do its job well, but humans do not fully trust it, simply because it is a machine. As passengers get into driverless cars with fear and trembling,

In fact, someone who wants to put his money at risk in the stock market trusts human experts more than artificial intelligence. Therefore, although artificial intelligence technology can help reduce human errors and increase the speed of decision-making in the financial market, it is not able to make reliable decisions for shareholders alone.

Therefore, to predict stock prices, the best result will be obtained if the two expertise of finance and data science are combined with artificial intelligence. In the future, as artificial intelligence gets better, it might make fewer mistakes. However, predicting social events like the stock market will always be uncertain.

Written by Saman Omidi