Over the past few years, a shift has shifted from Natural Language Processing (NLP) to the emergence of Large Language Models (LLMs). This evolution is fueled by the exponential expansion of available data and the successful implementation of the Transformer architecture.

Transformers, a type of Deep Learning model, have played a crucial role in the rise of LLMs. The flexibility they offer has led to the idea of LLM finance, healthcare, e-commerce, and much more.

Significance of Large Language Models

Large Language Models (LLMs) are revolutionizing the AI landscape by enabling machines to understand and generate human-like language. Trained on vast datasets, LLMs excel at tasks like summarizing, translating, predicting, and creating content with high accuracy. Their ability to recognize linguistic patterns and apply them contextually has made them invaluable across industries.

LLMs automate language tasks, such as drafting articles, answering customer queries, or translating languages, which increases efficiency and reduces human intervention. This capability has made them essential tools in areas like customer service, content creation, and research.

Beyond operational tasks, LLMs are enhancing creativity and productivity. They assist in generating ideas, drafting copy, and even conducting research, fostering innovation across sectors like healthcare, finance, and education. Their versatility makes them integral to improving workflows and driving new business opportunities.

Overall, LLMs are reshaping industries by enabling scalable solutions, improving decision-making, and unlocking new forms of creativity. Their continued development promises even greater capabilities in the future, making them essential tools for businesses and researchers alike.

Applications of LLMs in the Finance Industry

Applications of Large Language Models (LLMs) in the finance industry have gained significant traction in recent years. LLMs, such as GPT-4, BERT, RoBERTa, and specialized models like BloombergGPT, have demonstrated their potential to revolutionize various aspects of the fintech sector.

These cutting-edge technologies offer several benefits and opportunities for both businesses and individuals within the finance industry.

1. Fraud Detection and Prevention:

LLMs significantly enhance fraud detection in the financial sector by analyzing vast amounts of transaction data in real-time. They can quickly identify patterns of normal behavior and spot deviations that could indicate fraud, such as unusual spending patterns or transactions from unfamiliar locations. By learning from historical fraud data, LLMs improve over time, allowing them to detect emerging fraud schemes.

These models can also help minimize false positives by refining their understanding of legitimate customer behavior, providing more accurate fraud alerts and reducing disruption to legitimate transactions.

2. Risk Assessment and Management:

LLMs provide financial institutions with the tools to assess and manage risk more accurately. By analyzing data from a range of sources, including transaction histories, customer profiles, and external market data, LLMs can help assess the likelihood of loan defaults or investment risks. They can also analyze shifts in macroeconomic conditions, allowing businesses to adjust their strategies to mitigate risk proactively.

Additionally, LLMs can evaluate creditworthiness by considering more than just traditional credit scores, incorporating alternative data sources such as payment histories or even social media activity. This approach helps provide a more holistic view of potential risks, allowing for better decision-making and financial forecasting.

3. Personalized Customer Service:

AI-powered chatbots and virtual assistants fueled by LLMs are transforming customer service in the finance industry by providing personalized, instant responses to a wide range of customer queries. These models use natural language processing to understand and respond to complex questions in a conversational manner, helping customers with everything from basic account inquiries to personalized financial advice.

By continuously learning from interactions, these systems can offer increasingly relevant and specific advice, improving customer satisfaction. Moreover, LLMs allow for 24/7 availability, reducing wait times and enabling clients to resolve issues outside of traditional business hours.

4. Efficient Onboarding:

LLMs streamline the onboarding process by guiding customers through registration, verifying their identities, and recommending personalized financial products. AI models can help customers navigate the often complex world of financial products by offering real-time, tailored suggestions based on their preferences and financial situations.

Moreover, these models can automate paperwork, answer questions, and provide instant clarifications, reducing onboarding time and friction. This results in a more efficient process, higher conversion rates, and better customer retention as clients feel more supported from the moment they interact with a financial institution.

5. Advanced Financial Advice:

LLMs enable financial advisors to provide clients with data-driven, personalized advice by analyzing both individual financial data and broader market trends. These models can evaluate a client’s risk tolerance, financial goals, and historical investment performance to suggest suitable financial strategies. LLMs can also help by running simulations and providing projections, assisting clients in making better-informed decisions about retirement, investments, and wealth management.

For financial advisors, LLMs automate much of the research and analysis, freeing up time to focus on more strategic, relationship-building aspects of their work. This results in a more efficient advisory process and higher-quality advice for clients.

6. News Analysis and Sentiment Detection:

LLMs are adept at processing vast amounts of financial news, including articles, social media posts, and financial reports, to identify trends, market sentiment, and public opinions. By evaluating the tone and sentiment of news articles, LLMs can alert traders and investors to shifts in market conditions that may signal opportunities or risks.

For example, if LLMs detect a sudden negative shift in sentiment surrounding a particular company or industry, financial professionals can act quickly, making adjustments to their portfolios in real-time. This capability is invaluable for traders who need to stay ahead of market-moving news.

7. Data Analysis and Predictive Analytics:

LLMs excel at analyzing historical financial data and making predictions about future trends, from stock prices to economic shifts. These models can process data faster and more accurately than traditional methods, identifying patterns that might otherwise be missed. By applying machine learning algorithms, LLMs can predict market trends, assess investment opportunities, and optimize portfolios.

With their ability to handle massive datasets, LLMs also enable more precise forecasting, reducing the uncertainty inherent in financial decision-making. This predictive power enhances risk management, allowing institutions to anticipate potential issues before they arise and adjust strategies accordingly.

How Large Language Models Can Automate Financial Services?

Large language models have the potential to automate various financial services, including customer support and financial planning. These models, such as GPT (Generative Pre-trained Transformer), have been developed specifically for the financial services industry to accelerate digital transformation and improve competitiveness.

Read about —> How LLMs (Large Language Models) technology is making chatbots smarter?

One example of a large language model designed for banking is SambaNova GPT Banking.

This solution aims to address the deep learning deployment gap in the banking sector by jump-starting banks’ deep learning language capabilities in a matter of weeks, rather than years [1]. By subscribing to GPT Banking, banks can leverage the technology to perform various tasks:

1. Sentiment Analysis:

GPT Banking can scan social media, press, and blogs to understand market, investor, and stakeholder sentiment.

2. Entity Recognition:

It reduces human error by classifying documents and minimizing manual and repetitive work.

3. Language Generation:

The model can process, transcribe, and prioritize claims, extract necessary information, and create documents to enhance customer satisfaction.

4. Language Translation:

GPT Banking enables language translation to expand the customer base. The deployment of large language models like GPT Banking offers several benefits to financial institutions:

5. Efficiency and Time-saving:

By automating routine tasks, these models can enhance efficiency and productivity for financial service providers. AI-powered assistants can handle activities such as scheduling appointments, answering frequently asked questions, and providing essential financial advice, allowing human professionals to focus on more strategic and value-added tasks.

6. Personalized Customer Experience:

Large language models can provide instant and personalized responses to customer queries, enabling financial advisors to deliver real-time information and tailor advice to individual clients. This enhances the overall client experience and satisfaction.

7. Competitive Advantage:

Embracing AI technologies like large language models can give financial institutions a competitive edge. Early adopters can differentiate themselves by leveraging the power of AI to enhance their client experience, improve efficiency, and stay ahead of their competitors in the rapidly evolving financial industry.

Upscaling Financial Sector with LLM Finance

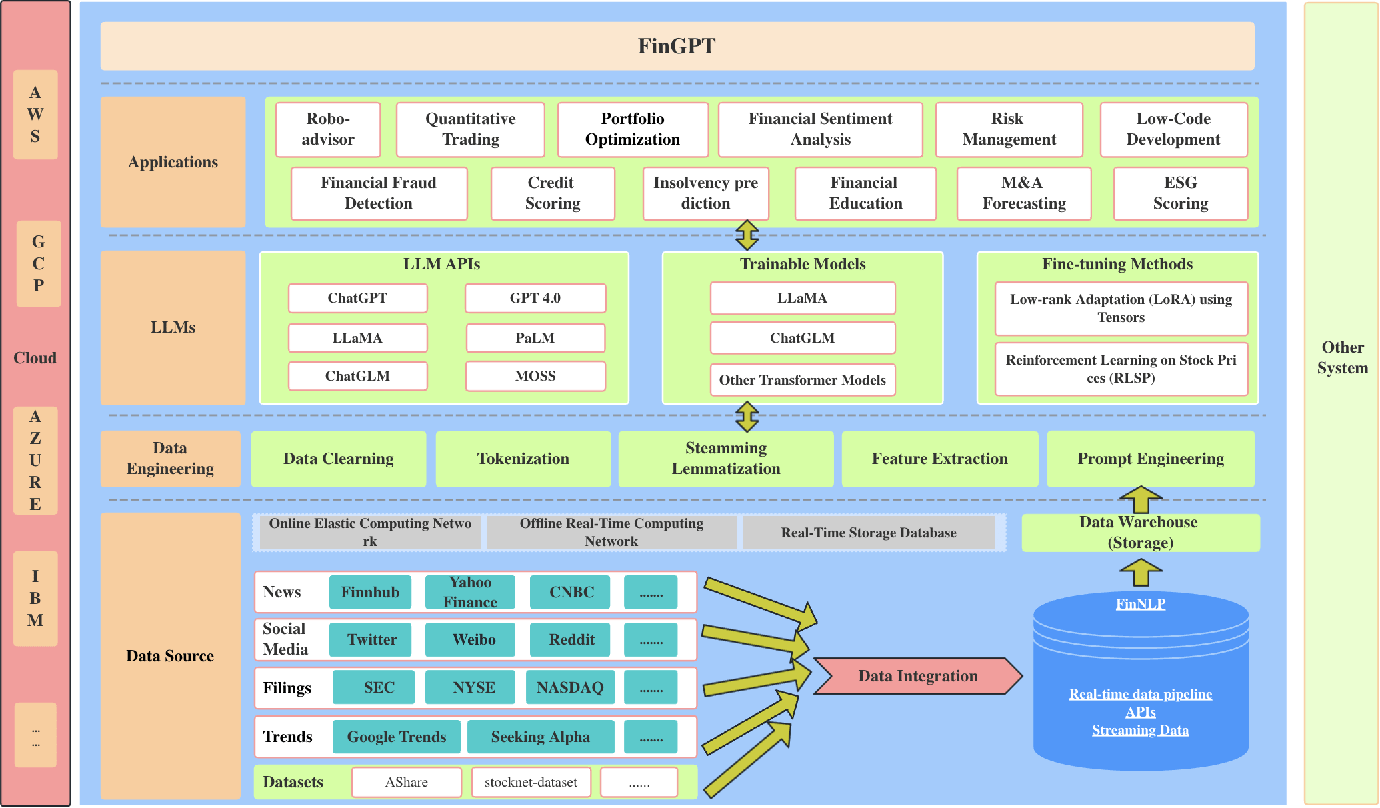

It’s worth noting that large language models can handle natural language processing tasks in diverse domains, and LLMs in the finance sector, can be used for applications like robo-advising, algorithmic trading, and low-code development.

These models leverage vast amounts of training data to simulate human-like understanding and generate relevant responses, enabling sophisticated interactions between financial advisors and clients.

Overall, large language models have the potential to significantly streamline financial services by automating tasks, improving efficiency, enhancing customer experience, and providing a competitive edge to financial institutions.