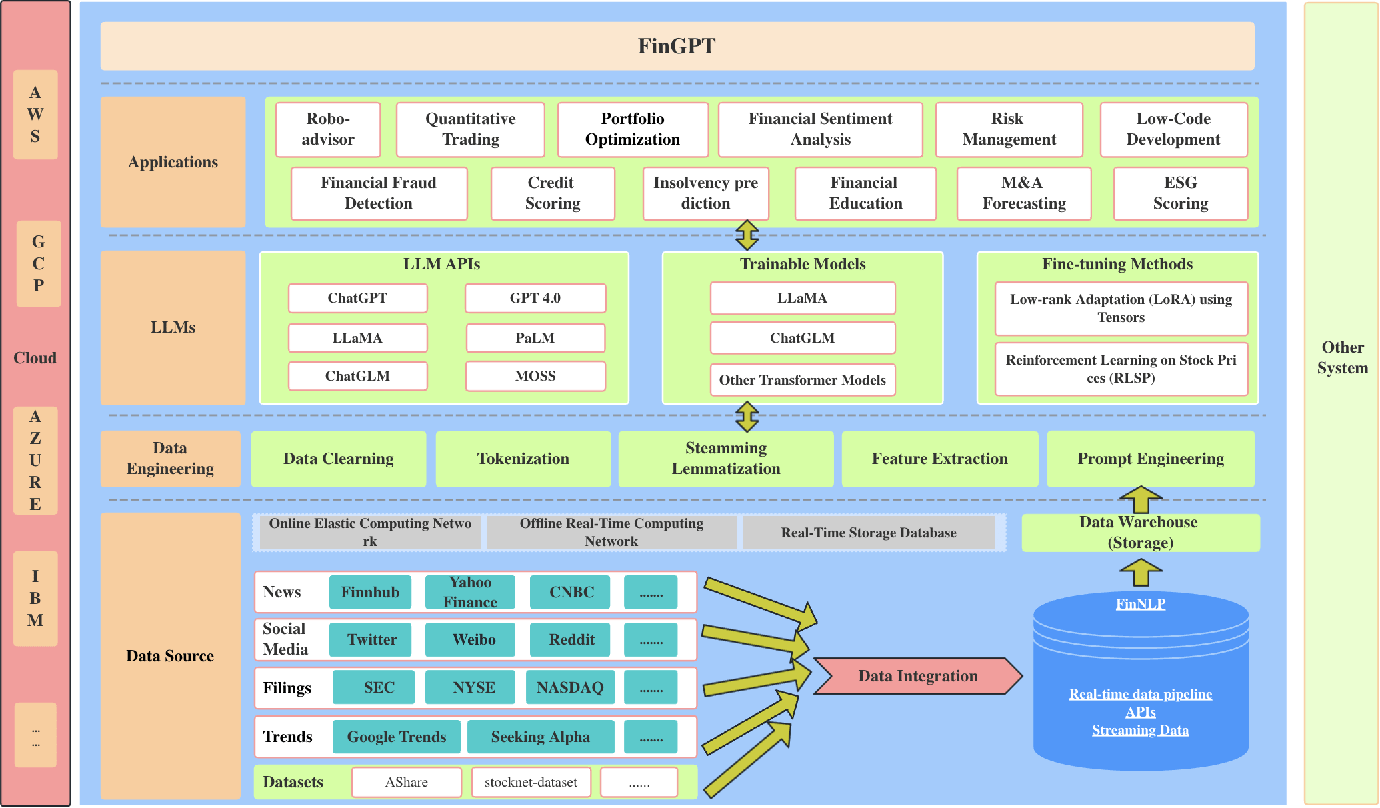

For AI in finance, LLMs contribute by automating mundane tasks, improving efficiency, and aiding decision-making processes. These models can analyze bank data, interpret complex financial regulations, and even generate reports or summaries from large datasets.

Learn how Generative AI is shaping the future of finance.

They offer the promise of cutting coding time by as much as fifty percent, which is a boon for developing financial software solutions. Furthermore, LLMs are aiding in creating more personalized customer experiences and providing more accurate financial advice, which is particularly important in an industry that thrives on trust and personalized service.

Explore LLM Guide: A Beginner’s Resource to the Decade’s Top Technology

As the financial sector continues to integrate AI, LLMs stand out as a transformative force, driving innovation, efficiency, and improved service delivery.

Generative AI’s Impact on Tax and Accounting

Finance, tax, and accounting have always been fields where accuracy and compliance are non-negotiable. In recent times, however, these industries have been witnessing a remarkable transformation thanks to the emergence of generative AI.

Explore the Top 7 Generative AI courses offered online

Leading the charge are the “Big Four” accounting firms. PwC, for instance, is investing $1 billion to ramp up its AI capabilities, while Deloitte has taken the leap by establishing an AI research center. Their goal? To seamlessly integrate AI into their services and support clients’ evolving needs.

But what does generative AI bring to the table? Well, it’s not just about automating everyday tasks; it’s about redefining how the industry operates. With regulations becoming increasingly stringent, AI is stepping up to ensure that transparency, accurate financial reporting, and industry-specific compliance are met.

Read more about Large Language Models in Finance industry

The Role of Generative AI in Accounting Innovation

One of the most remarkable aspects of generative AI is its ability to create synthetic data. Imagine dealing with situations where data is scarce or highly confidential. It’s like having an expert at your disposal who can generate authentic financial statements, invoices, and expense reports. However, with great power comes great responsibility.

Understand the Generative AI Roadmap

While some generative AI tools, like ChatGPT, are accessible to the public, it’s imperative to approach their integration with caution. Strong data governance and ethical considerations are crucial to ensuring data integrity, eliminating biases, and adhering to data protection regulations.

On this verge, the finance and accounting world also faces a workforce challenge. Deloitte reports that 82% of hiring managers in finance and accounting departments are struggling to retain their talented professionals.

Generative AI, including advanced machine learning models, is transforming the finance and accounting sectors by enhancing data analysis and providing deeper insights for strategic decision-making.

Understand the Ethics and Societal Impact of Generative AI and trends

Real-world Applications of AI Tools in Finance

Vic.ai

Vic.ai transforms the accounting landscape by employing artificial intelligence to automate intricate accounting processes. By analyzing historical accounting data, Vic.ai enables firms to automate invoice processing and financial planning.

A real-life application of Vic.ai can be found in companies that have utilized the platform to reduce manual invoice processing by tens of thousands of hours, significantly increasing operational efficiency and reducing human error.

Understand Type I and Type II Errors

Scribe

Scribe serves as an indispensable tool in the financial sector for creating thorough documentation. For instance, during financial audits, Scribe can be used to automatically generate step-by-step guides and reports, ensuring consistent and comprehensive records that comply with regulatory standards.

Tipalti

Tipalti’s platform revolutionizes the accounts payable process by using AI to streamline invoice processing and supplier onboarding.

Companies like Twitter have adopted Tipalti to automate their global B2B payments, thereby reducing friction in supplier payments and enhancing financial operations.

FlyFin & Monarch Money

FlyFin and Monarch Money leverage AI to aid individuals and businesses in tax compliance and personal finance tracking.

FlyFin, for example, uses machine learning to identify tax deductions automatically, while Monarch Money provides AI-driven financial insights to assist users in making informed financial decisions.

Learn Data Science in Finance and 5 essential Metrics for Small Businesses

Docyt, BotKeeper, and SMACC

Docyt, BotKeeper, and SMACC are at the forefront of accounting automation. These platforms utilize AI to perform tasks ranging from bookkeeping to financial analysis.

An example includes BotKeeper’s ability to process and categorize financial data, thus providing accountants with real-time insights and freeing them to tackle more strategic, high-level financial planning and analysis.

These AI tools exemplify the significant strides being made in automating and optimizing financial tasks, enabling a focus shift toward value-added activities and strategic decision-making within the financial sector

Transform the Industry using AI in Finance

In conclusion, generative AI is reshaping the way we approach financial operations. Automation is streamlining tedious, repetitive tasks, freeing up professionals to focus on strategic endeavors like financial analysis, forecasting, and decision-making.

Explore Top 8 Data Science Use Cases in the Finance Industry

Generative AI promises improved accuracy, efficiency, and compliance, making the future of finance brighter than ever.