Imagine a world where banks predict fraud before it happens, customer service chatbots provide financial advice with human-like precision, and investment strategies are generated in real time. Except it is becoming today’s reality with the growing impact of AI in financial services.

According to EY, financial services have the potential to create US$200b to US$400b in value by 2030 with the use of generative AI at its core. This promised improvement with AI adoption signals a major shift in how AI will be transforming the Banking, Financial Services, and Insurance (BFSI) industry.

At the heart of this revolution is Generative AI, which is reshaping the industry, offering improved performance in various financial aspects – from fraud prevention to algorithmic trading and more.

But how exactly is it being used? And what are the challenges ahead?

Let’s explore how Generative AI is revolutionizing the BFSI sector and what it means for the future of finance.

The Role and Impact of Generative AI in BFSI

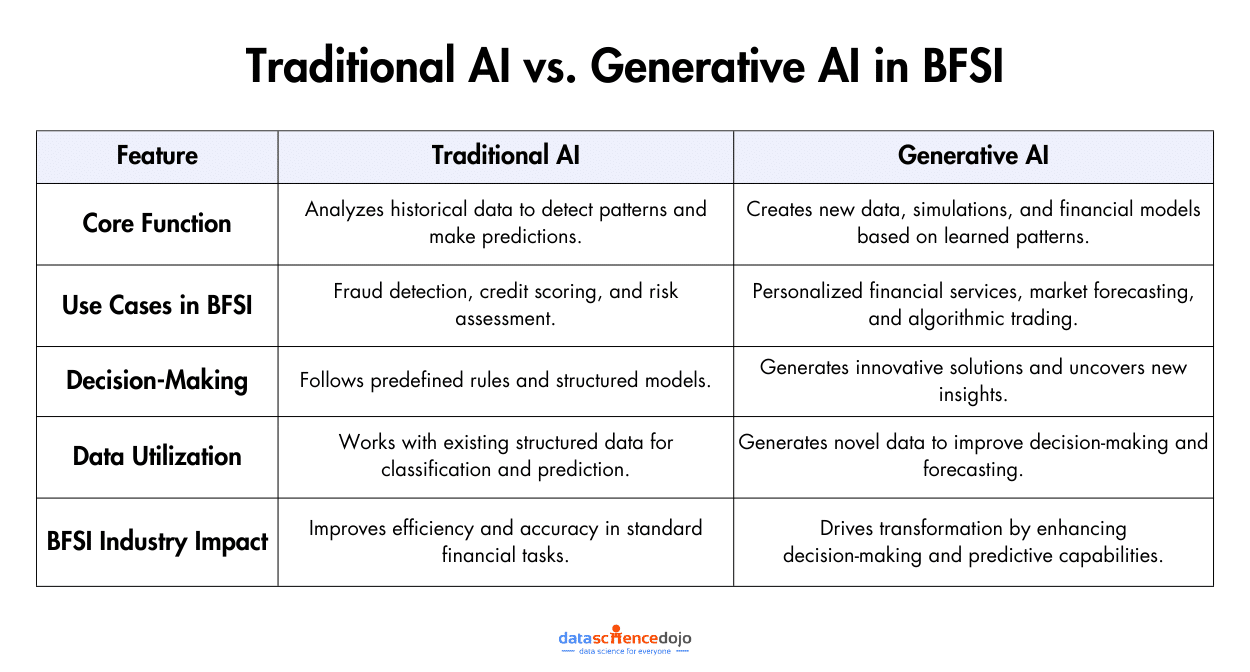

Traditional AI and generative AI serve different purposes in the world of artificial intelligence. Traditional AI focuses on analyzing historical data to recognize patterns, make predictions, and automate decision-making.

It is commonly used in fraud detection, credit scoring, and risk assessment, where models are trained to classify or predict outcomes based on existing information. These AI systems rely on predefined rules and structured data, making them powerful but limited to working with what already exists.

Generative AI, on the other hand, goes beyond analyzing data and involves creating new data. Instead of just detecting patterns, it generates text, images, simulations, and even financial models based on learned information.

This makes it highly useful in areas like personalized financial services, market forecasting, and algorithmic trading. While traditional AI helps interpret data, generative AI takes it a step further by producing innovative solutions, uncovering new insights, and enhancing decision-making in the BFSI sector.

Here’s a roadmap to create personalized Q&A chatbots

Generative AI is changing the way banks and financial institutions operate. It is not just automating tasks but creating smarter, more efficient systems. The technology is improving everything from fraud detection to customer service.

It is helping banks reduce costs, enhance security, and improve customer experiences. As AI adoption grows, more financial institutions will use Generative AI to stay competitive.

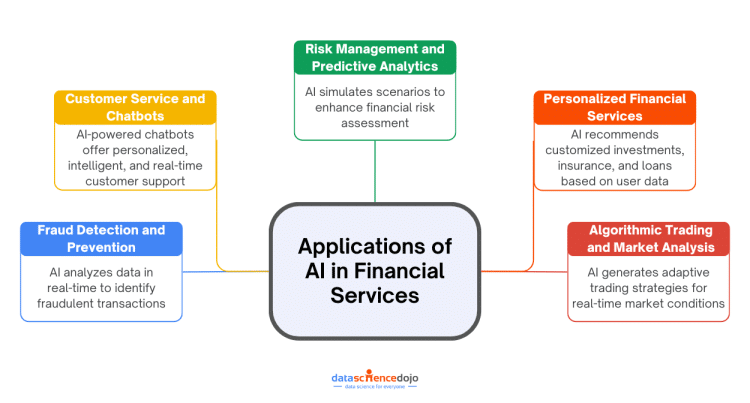

Applications of Generative AI in BFSI

Generative AI is a game-changer in the realm of BFSI that offers innovative solutions that are more secure and customer-centric. It results in financial services becoming more efficient, adaptive, and personalized.

Let’s explore some key applications of generative AI in BFSI.

Fraud Detection and Prevention

Fraud is one of the biggest challenges in the financial sector, costing institutions billions of dollars annually. Generative AI enhances fraud detection by analyzing vast datasets in real-time, identifying suspicious patterns, and predicting fraudulent activities before they occur.

Traditional fraud detection models rely on rule-based systems and historical data, struggling to adapt to new fraud tactics. In contrast, GenAI can recognize anomalies and evolving fraud patterns dynamically, making it far more effective against sophisticated cybercriminals.

By continuously learning from new data, generative models can proactively safeguard financial institutions and their customers, reducing financial losses and improving overall security.

Customer Service and Chatbots

The BFSI market has witnessed a surge in the use of chatbots and virtual assistants to enhance customer service. Traditional chatbots often provide scripted, limited responses, frustrating customers with complex inquiries, while AI-powered bots can ensure instant and personalized customer support.

Generative AI takes this a step further by enabling more natural and context-aware conversations. These AI-driven assistants can:

- Understand complex queries and respond intelligently

- Offer personalized financial advice based on user data

- Assist with transactions, account inquiries, and troubleshooting in real time

- Learn from past interactions to improve future responses

This results in higher customer satisfaction, reduced wait times, and more efficient service delivery, ultimately enhancing the overall banking experience.

Learn to build AI-based chatbots in Python

Risk Management and Predictive Analytics

Managing risks effectively is a cornerstone of the BFSI industry as financial institutions must evaluate creditworthiness, investment risks, and market fluctuations. Before generative AI, models relied on historical data and predefined risk parameters, resulting in limited accuracy.

Generative AI contributes by improving risk assessment models. By generating realistic scenarios and simulating various market conditions, these models enable financial institutions to make more informed decisions and mitigate potential risks before they escalate.

Financial institutes can use generative AI for:

- Credit risk analysis: Evaluating borrowers’ financial history and predicting default probabilities

- Market risk forecasting: Simulating economic fluctuations to optimize investment decisions

- Operational risk assessment: Detecting vulnerabilities in banking processes before they cause disruptions

By anticipating risks before they escalate, banks and financial institutions can take proactive measures to minimize financial losses.

Understand how predictive analytics and AI work together

Personalized Financial Services

AI enables the creation of personalized financial products and services tailored to individual customer needs. By analyzing vast amounts of data, including transaction history, spending patterns, and preferences, generative models can recommend personalized options, such as:

- Tailored investment portfolios for wealth management

- Custom insurance plans based on customer profiles

- Dynamic loan offers with optimized interest rates

This level of personalization improves customer engagement, enhances trust, and helps financial institutions retain loyal clients in a competitive market.

Algorithmic Trading and Market Analysis

In the world of high-frequency trading (HFT), generative AI is making significant strides. These models can analyze market trends, historical data, and real-time information to generate trading strategies that adapt to changing market conditions.

AI-powered trading systems can generate and execute trading strategies automatically, optimizing them for current market conditions. This results in:

- Faster decision-making with reduced human intervention

- Minimized financial risks through predictive market analysis

- Higher profitability by seizing opportunities in volatile markets

By leveraging AI-driven trading strategies, financial institutions gain a competitive edge, maximize returns, and reduce the risk of losses.

Learn in detail about the power of large language models in the financial industry

Generative AI has become a core driver of innovation in BFSI. As financial institutions continue to adopt and refine generative AI solutions, the industry will witness greater efficiency, enhanced security, and more personalized financial experiences for customers.

Financial firms that embrace AI-driven transformation will not only stay ahead of the competition but also shape the future of banking and financial services in an increasingly digital world.

Use Cases of Generative AI in Financial Services

Generative AI is increasingly being adopted in finance and accounting for various innovative applications. Here are some real-world examples and use cases:

Read more about: Top 15 AI startups developing financial services

Document analysis: Many finance and accounting firms use generative AI for document analysis. This involves extracting and synthesizing information from financial documents, contracts, and reports.

Conversational finance: Companies like Wells Fargo are using generative AI to enhance customer service strategies. This includes deploying AI-powered chatbots for customer interactions, offering financial advice, and answering queries with higher accuracy and personalization.

Financial report generation: Generative AI is used to automate the creation of comprehensive financial reports, enabling quicker and more accurate financial analysis and forecasting.

Quantitative trading: Companies like Tegus, Canoe, Entera, AlphaSense, and Kavout Corporation are leveraging AI in quantitative trading. They utilize generative AI to analyze market trends, historical data, and real-time information to generate trading strategies.

Capital markets research: Generative AI aids in synthesizing vast amounts of data for capital market research, helping firms identify investment opportunities and market trends.

Enhanced virtual assistants: Financial institutions are employing AI to create advanced virtual assistants that provide more natural and context-aware conversations, aiding in financial planning and customer service.

Regulatory code change consultant: AI is used to keep track of and interpret changes in regulatory codes, a critical aspect of compliance in finance and banking.

Personalized financial services: Financial institutions are using generative AI to create personalized offers and services tailored to individual customer needs and preferences, enhancing customer engagement and satisfaction.

These examples showcase how generative AI is not just a technological innovation but a transformative force in the finance and accounting sectors, streamlining processes and enhancing customer experiences.

Generative AI Knowledge Test

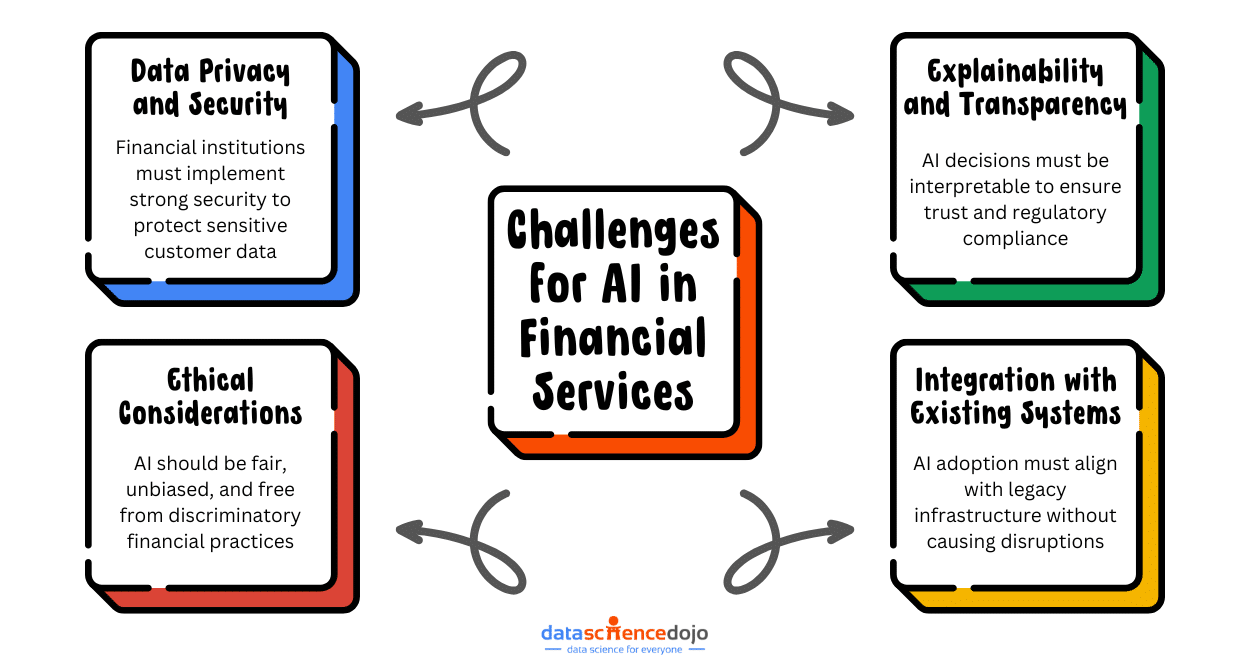

Challenges and Considerations for AI in Financial Services

While the potential benefits of generative AI in the BFSI market are substantial, it’s important to acknowledge and address the challenges associated with its implementation.

Data Privacy and Security

The BFSI sector deals with highly sensitive and confidential information. Implementing generative AI requires a robust security infrastructure to protect against potential breaches. Financial institutions must prioritize data privacy and compliance with regulatory standards to build and maintain customer trust.

Explainability and Transparency

The complex nature of generative AI models often makes it challenging to explain the reasoning behind their decisions. In an industry where transparency is crucial, financial institutions must find ways to make these models more interpretable, ensuring that stakeholders can understand and trust the outcomes.

Ethical Considerations

As with any advanced technology, there are ethical considerations surrounding the use of generative AI in finance. Ensuring fair and unbiased outcomes, avoiding discriminatory practices, and establishing clear guidelines for ethical AI use are essential for responsible implementation.

Read more about ethics in AI

Integration with Existing Systems

The BFSI sector typically relies on legacy systems and infrastructure. Integrating GenAI seamlessly with these existing systems poses a technical challenge. Financial institutions need to invest in technologies and strategies that facilitate a smooth transition to generative AI without disrupting their day-to-day operations.

The Future of Generative AI in BFSI

Generative AI is set to transform the BFSI industry, giving financial institutions a competitive edge by enhancing customer experiences, optimizing operations, and improving decision-making. Here’s what to expect:

- Smarter customer engagement – AI-powered virtual advisors and chatbots will provide more personalized and interactive banking experiences.

- Continuous innovation – AI will drive new financial products, investment opportunities, and customized financial solutions.

- Better fraud prevention – Advanced AI models will detect fraud in real-time, reducing risks and enhancing security.

- Simplified compliance – AI will automate regulatory reporting, making compliance faster and more efficient.

While challenges exist, the benefits far outweigh the drawbacks. Banks and financial institutions that embrace AI in financial services will lead the way in shaping the future of finance.

Written by Chaitali Deshpande