The finance industry has traditionally been driven by human expertise and intuition. However, with the explosion of data and the advent of new technologies, the industry is starting to embrace the use of artificial intelligence (AI) to manage and analyze this data. This has led to the emergence of the financial technology (FinTech) industry, which is focused on using technology to make financial services more accessible, efficient, and customer friendly.

AI in FinTech is like having a financial expert who never sleeps, never gets tired, and never complains about coffee.

AI has been at the forefront of this transformation, helping companies to automate repetitive tasks, make more informed decisions, and improve customer experience. In FinTech, AI has been particularly valuable, given the massive amounts of data that financial institutions generate. AI-powered algorithms can process this data, identify trends and patterns, and help companies to better understand their customers and offer personalized financial products and services.

Continue reading to know more about artificial intelligence (AI) in the financial technology (FinTech) industry, and how it is transforming the finance industry.

Exploring the Popularity of AI: An Overview

AI is changing the way we work, live, and handle money. It’s making things faster, smarter, and more efficient across different industries—but one of the biggest areas seeing its impact is finance.

In banking and financial services, AI helps detect fraud, manage risks, and automate customer support with chatbots. It can analyze huge amounts of data in seconds, helping banks make smarter lending decisions and offering customers personalized investment advice. If you’ve ever used a budgeting app that tracks your spending or gotten a quick loan approval online, AI was likely behind it.

Beyond banking, AI is transforming stock trading, helping investors make better decisions with predictive analytics. It’s also improving security, flagging suspicious transactions in real-time to prevent fraud. Even insurance companies use AI to assess claims faster and offer better pricing.

AI isn’t just making financial services more efficient—it’s also making them more accessible. More people can now get loans, investment advice, and secure banking services, no matter where they are. As AI keeps evolving, it’s set to make finance smarter, safer, and more personalized than ever.

A Bird’s-Eye View: AI and FinTech

The FinTech industry is built on innovation and disruption. It has always been focused on using technology to make financial services more accessible, efficient, and customer friendly. AI is at the forefront of this innovation, helping companies to take their services to the next level.

One of the most significant benefits of AI in FinTech is that it allows companies to make more informed decisions. AI-powered algorithms can process vast amounts of data and identify trends and patterns that would be impossible for humans to detect. This allows financial institutions to make more accurate predictions and improve their risk management strategies.

Also explore: Top fintech trends

Another benefit of AI in FinTech is the ability to automate repetitive tasks. Many financial institutions still rely on manual processes, which are time-consuming and prone to errors. AI-powered systems can automate these tasks, freeing up employees to focus on more complex and value-adding activities.

AI is also making a big impact on customer experience. AI-powered chatbots and virtual assistants can provide customers with 24/7 support and personalized recommendations, improving customer satisfaction and loyalty. AI can also help financial institutions to better understand their customers’ needs and preferences, enabling them to offer tailored financial products and services.

Exploring Opportunities: How AI Is Revolutionizing the FinTech Future

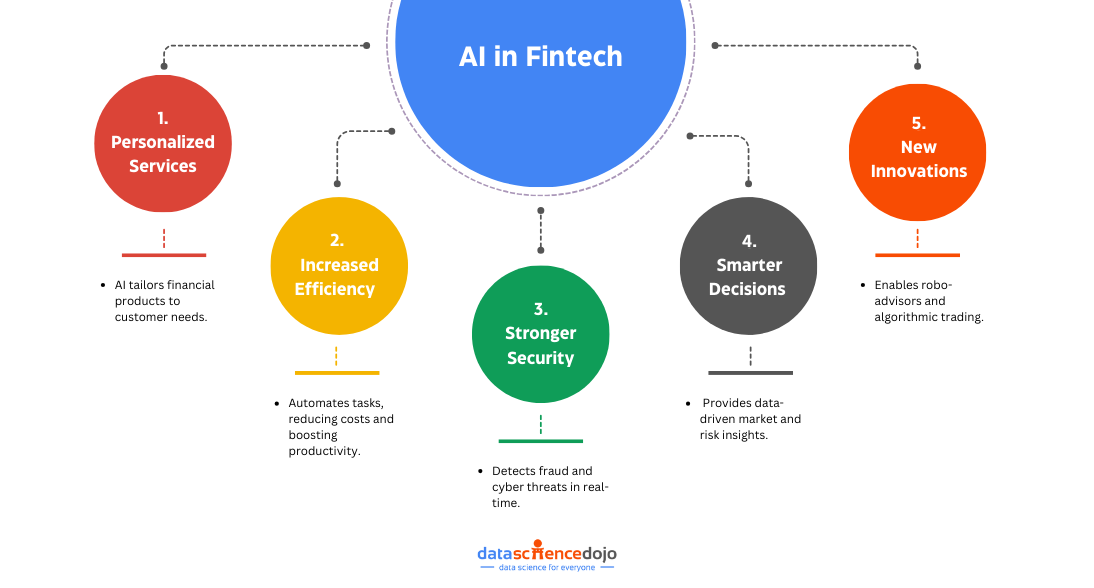

The use of AI in the FinTech industry also presents significant opportunities for financial institutions to improve their operations and better serve their customers. Here are some of the key opportunities:

1. Improved Customer Experience

AI-powered systems can help financial institutions better understand their customers and their needs. By using AI to analyze customer data, companies can provide personalized services and tailored financial products that better meet the needs of individual customers.

2. Enhanced Efficiency

AI can automate repetitive and time-consuming tasks, such as data entry and fraud detection, freeing up employees to focus on more complex and value-adding activities. This can lead to increased productivity, reduced costs, and faster response times.

3. Better Risk Management

AI can help financial institutions to identify and mitigate potential risks, such as fraud and cyber threats. By analyzing large amounts of data, AI can detect unusual patterns and suspicious activities, enabling companies to take proactive measures to prevent or minimize risk.

4. Enhanced Decision-Making

AI-powered systems can provide financial institutions with more accurate and timely insights, enabling them to make more informed decisions. By using AI to analyze data from multiple sources, companies can gain a better understanding of market trends, customer preferences, and potential risks.

5. New Business Opportunities

AI can enable financial institutions to develop new products and services, such as robo-advisors and algorithmic trading. These innovations can help companies to expand their offerings and reach new customer segments.

Future Trends in AI and FinTech

As AI continues to evolve, its role in FinTech is expanding, paving the way for smarter, more efficient, and accessible financial services. Several key trends are shaping the future of AI in FinTech, driving innovation and transforming how financial institutions operate.

AI-Powered Wealth Management

AI is redefining wealth management by offering intelligent, data-driven insights for investors. Robo-advisors, powered by AI, are becoming more sophisticated, providing personalized investment strategies based on real-time market analysis and individual risk tolerance.

These tools enable investors—both seasoned professionals and newcomers—to make informed decisions with minimal effort. Machine learning models can also predict market trends, helping financial firms optimize portfolio management and mitigate risks.

Green FinTech and Sustainable Finance

Sustainability is becoming a major focus in finance, and AI is playing a crucial role in promoting green FinTech solutions. AI-driven algorithms help assess ESG (Environmental, Social, and Governance) criteria, allowing investors to make responsible investment choices.

FinTech firms are using AI to develop carbon footprint tracking tools, enabling businesses and individuals to monitor and reduce their environmental impact. Additionally, AI is improving efficiency in green lending by assessing the sustainability of projects and optimizing funding allocation for environmentally friendly initiatives.

Integration of Central Bank Digital Currencies (CBDCs)

With central banks worldwide exploring the potential of digital currencies, AI is expected to play a significant role in their implementation. AI-driven analytics can enhance the security and efficiency of CBDC transactions, ensuring smooth integration with existing financial systems.

Moreover, AI-powered fraud detection can help monitor and prevent illicit activities within digital currency networks. As CBDCs gain traction, AI will be instrumental in managing risks, improving transaction speeds, and ensuring regulatory compliance.

Navigating Challenges of AI in FinTech

Using AI in the FinTech industry presents several challenges that need to be addressed to ensure the responsible use of this technology. Two of the primary challenges are fairness and bias, and data privacy and security.

The first challenge relates to ensuring that the algorithms used in AI are fair and unbiased. These algorithms are only as good as the data they are trained on, and if that data is biased, the algorithms will be too. This can result in discrimination and unfair treatment of certain groups of people. The FinTech industry must address this challenge by developing AI algorithms that are not only accurate but also fair and unbiased, and regularly auditing these algorithms to address any potential biases.

The second challenge is data privacy and security. Financial institutions handle sensitive personal and financial data, which must be protected from cyber threats and breaches. While AI can help identify and mitigate these risks, it also poses new security challenges. For instance, AI systems can be vulnerable to attacks that manipulate or corrupt data. The FinTech industry must implement robust security protocols and ensure that AI systems are regularly audited for potential vulnerabilities. Additionally, they must comply with data privacy regulations to safeguard customer data from unauthorized access or misuse.

Conclusion

Through AI in FinTech, financial institutions can manage and analyze their data more effectively, improve efficiency and accuracy, and provide better financial services to customers. While there are challenges associated with using AI in FinTech, the opportunities are vast, and the potential benefits are enormous. As the finance industry continues to evolve, AI will be a game-changer in managing the finance of the future.